What is in store for the trucking industry in this economic cycle?

Many are concerned with record-high inflation, climbing interest rates, and what could be next.

The transportation industry is an essential part of the economy and households who rely on the goods we deliver around the country. And while there is demand for us to be running 365 days a year, we are also especially susceptible to being affected by the economic hardships in the U.S. economy. We can’t slow down and take time to adjust to the upcoming market changes. Our industry has to adapt and adjust all while running critical freight around the country. That is why it is important to be aware of what is happening and plan ahead so you aren’t blindsided by what is to come. Especially as we enter a season of increased volumes with no time to spare!

Inflation Impact

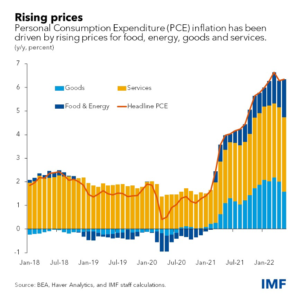

Inflation has affected the trucking industry across the board with record breaking fuel price increases and higher consumer prices. From January to June 2022, the price of regular motor gasoline rose 49% and the price of diesel fuel rose slightly more at 55% according to the Bureau of Transportation Statistics. While the government continues to try to reel inflation back in to a 2% target, the prices of goods, food, and transportation have inflated well beyond that range. As of October 2022, the U.S. inflation rate is 8.1% and our real GDP growth is only 1.6%. The International Monetary Fund’s research shows these increases could become long lasting.

Interest Rates Ripple Effect

To combat inflation, the Federal Reserve (the Fed) has made steep increases in 2022 to the interest rate. While this is a good thing for your money you have in savings (because you will earn a higher interest rate return), it can be problematic when it ripples through the rest of the economy. If you borrow money for your business through loans or lines of credit with variable interest rates, you will be paying a higher price in interest. The higher interest rates could also limit consumer spending as they will have less disposable income. Higher interest rates could cause suppliers to increase their prices, which paired with less consumer spending, could affect supply and demand. Some say we are in for a recession while others predict we will reel in high inflation and economic growth will resume. Whether the economy recovers at a slow pace or not, companies should be ready for a potential slowdown.

The Silver Lining

Despite all the disruptions and challenges, the logistics industry has been through tough times before. RMX Global Logistics has been helping shippers broker their loads for nearly 40 years. And with 40 years of carrier relationships and experience navigating all sorts of market conditions, we have an optimistic outlook on the future.

Keep your business moving with RMX!